ETH Price Prediction: Navigating the Path to $6,400 Amid Market Volatility

#ETH

- Technical Positioning: ETH trades below key moving averages but shows MACD momentum and Bollinger Band support levels that could catalyze a rebound

- Institutional Confidence: Major purchases by institutions like BitMex and ETF filings indicate strong fundamental backing despite short-term price weakness

- Market Sentiment Divergence: While price action appears bearish, development activity and accumulation patterns suggest underlying bullish momentum building

ETH Price Prediction

Technical Analysis: ETH Price at Critical Juncture

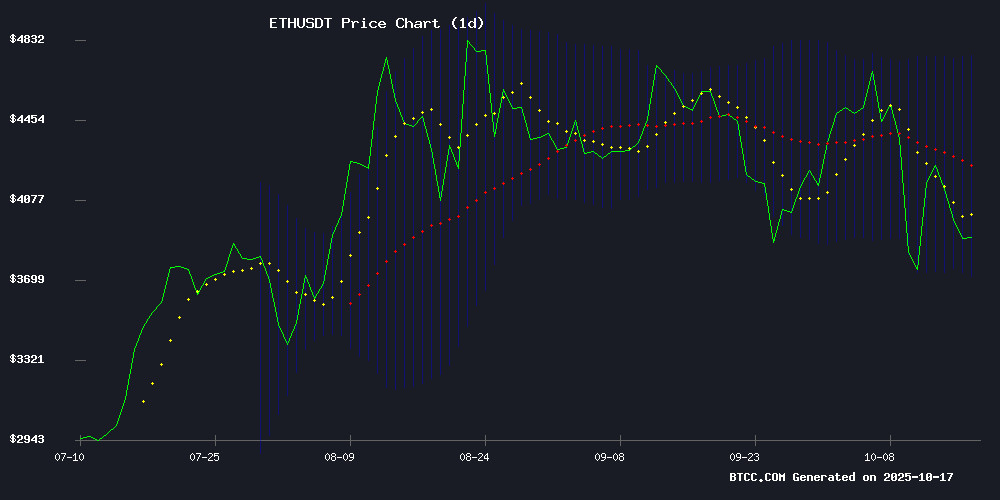

ETH is currently trading at $3,840, below its 20-day moving average of $4,234, indicating short-term bearish pressure. However, the MACD shows positive momentum with the histogram at 98.52, suggesting potential upward movement. The Bollinger Bands position ETH NEAR the lower band at $3,702, which could act as support. According to BTCC financial analyst William, 'The technical setup shows ETH is testing key support levels. A bounce from current levels could target the middle Bollinger Band around $4,234.'

Market Sentiment: Mixed Signals Amid Institutional Accumulation

Recent news presents a conflicting picture for Ethereum. Positive developments include VanEck's staked ETH ETF filing and BitMex's $417 million purchase, signaling strong institutional confidence. However, bearish factors include North Korean hacking threats and recent price declines below $4,000. BTCC financial analyst William notes, 'While short-term sentiment appears negative due to price action, the underlying institutional accumulation and development activity suggest long-term bullish fundamentals remain intact.'

Factors Influencing ETH's Price

Ethereum’s Developer Boom Signals Bullish Momentum for ETH

Ethereum's ecosystem is witnessing an unprecedented surge in developer activity, with 16,181 new developers joining in the first ten months of 2025. This brings the total to 31,869, reinforcing ETH's dominance as the blockchain of choice for builders. The trend mirrors the 2019-2020 developer influx that preceded the DeFi explosion, suggesting another major adoption cycle may be imminent.

Network growth metrics support the bullish thesis. Ethereum's total value locked (TVL) has climbed to $85 billion, maintaining a 56% share of the DeFi market. Developers are prioritizing scaling solutions and efficiency, with innovations like Pico Prism driving real-world asset tokenization to $12 billion. These fundamentals underscore Ethereum's ability to retain its 'legacy blockchain' status while remaining competitive against faster alternatives.

Ethereum’s Price Dips Below $4K Amid Market Weakness, But Rebound Signals Emerge

Ethereum slipped below the $4,000 threshold again as broader crypto markets faced selling pressure. Yet on-chain metrics suggest accumulating investor confidence—a historical precursor to reversals.

Short-term holders are now underwater, with STH-NUPL entering capitulation territory. This phase often marks local bottoms, as seen in previous cycles. Speculative positions from the recent rally are being flushed out, creating room for renewed demand.

HODL waves reveal steadfast conviction among Core holders. The migration of 11.94% of supply into 3-6 month wallets indicates a maturing investor base. Such accumulation patterns typically precede upside breaks in Ethereum’s price discovery phases.

Reviving Digital Art as NFTs: A Market Opportunity

The NFT market continues to expand beyond contemporary digital art, offering creators a pathway to monetize archived works. ethereum remains the dominant blockchain for minting, with platforms like OpenSea and Rarible serving as primary marketplaces.

High-resolution file preparation and blockchain selection FORM the critical first steps in this process. JPEGs and PNGs dominate the space, with creators advised to prioritize quality for optimal display across devices and platforms.

Market dynamics suggest growing collector interest in rediscovered works, particularly those with verifiable provenance. The process democratizes art ownership while creating new revenue streams for creators across skill levels.

Ethereum Price Could Surge To $6,400 With New Bullish Wave, But Resistance Looms

Ethereum's recent pullback to $4,000 has done little to dampen bullish sentiment, with analysts eyeing a potential 50% surge toward $6,400. The second-largest cryptocurrency continues to trade between key support and resistance levels, with $4,500 emerging as a critical threshold.

Crypto analyst HAMED_AZ notes Ethereum's consolidation could precede a short-term correction toward $3,600 support. A successful test of this level may establish the foundation for the next leg up, following the ascending trendline that has guided ETH's price action.

The projected breakout scenario mirrors previous bullish cycles, where Ethereum demonstrated resilience after testing structural supports. Market participants appear to be positioning for volatility, with derivatives data showing sustained demand for ETH exposure despite recent price turbulence.

Ethereum Price Analysis: $3.5K Support Test Looms After 13% Weekly Decline

Ether's correction deepened as it breached critical support levels, sliding toward the $3,500 Fibonacci retracement zone. The second-largest cryptocurrency by market cap now faces its most significant technical test since August, with the 100-day moving average proving insufficient to halt the sell-off.

Market structure turned decisively bearish after ETH failed to reclaim $4,200 resistance. The daily chart shows a clean break below both the ascending channel and key moving averages—a development that typically precedes extended downtrends. Current price action suggests traders are anticipating a retest of the August rally's foundation NEAR $3,530.

Momentum indicators paint a concerning picture. The RSI's plunge to 37 on daily charts and 33 on the 4-hour timeframe confirms strong bearish control without yet reaching oversold conditions. Should $3,500 support falter, the 0.618 Fib level at $3,200 becomes the next logical target.

VanEck Files for Lido Staked Ethereum ETF with SEC

VanEck has submitted an S-1 registration statement to the U.S. Securities and Exchange Commission for a Lido Staked Ethereum ETF. The proposed fund aims to provide investors with exposure to staked Ethereum, reflecting growing institutional interest in yield-bearing crypto products.

The MOVE signals continued confidence in Ethereum's proof-of-stake ecosystem despite regulatory uncertainties. Lido's liquid staking solution currently dominates the market, handling over 30% of all staked ETH.

North Korean Hackers Use New EtherHiding for Crypto Hacks

Google's Threat Intelligence Group has uncovered a new tactic by North Korean hackers involving EtherHiding to facilitate cryptocurrency theft. The method underscores the evolving sophistication of cyber threats in the digital asset space.

While the report did not specify impacted coins or exchanges, the development highlights the persistent risks facing blockchain networks and trading platforms. Security remains a critical concern as attackers refine their strategies to exploit vulnerabilities.

Ethereum Correction Nears End as Binance Funding Rates Hint at Rally to $6,800

Ethereum's recent price correction appears to be concluding, with the cryptocurrency stabilizing above $4,000 after briefly testing $3,400 last week. Binance funding rates remain positive but restrained, suggesting long positions dominate without excessive speculation.

Current funding rates of 0.01% to 0.03% contrast sharply with the 0.1% to 0.2% levels seen during 2021's market peaks. This divergence indicates room for upward movement before reaching overheated conditions. The absence of negative rates further confirms declining short interest and growing risk appetite among traders.

Historical patterns suggest Ethereum's current consolidation between $3,600 and $3,800 may represent the final phase of correction before resuming its upward trajectory. Market structure mirrors early-stage bull market conditions rather than late-cycle euphoria.

Ethereum Price Slides Below $4,000 Support As Sellers Tighten Grip

Ethereum's price action turned bearish as it failed to hold above the $4,020 support level, sliding below $4,000 amid increasing selling pressure. The second-largest cryptocurrency now faces consolidation within a narrowing range, with technical indicators suggesting potential further downside if the $3,820 support breaks.

A pronounced bearish trend line has formed on the hourly chart, with resistance firmly established at $4,070. The 100-hour Simple Moving Average reinforces this resistance zone, creating multiple barriers for any recovery attempt. Market participants are watching the 23.6% Fibonacci retracement level near $3,950 as the immediate upside hurdle.

The current price movement reflects broader market weakness, with Ethereum mirroring Bitcoin's corrective pattern. Trading volume patterns and order book data from Kraken show concentrated liquidity near the $3,800-$3,850 zone, which may determine the next directional move. A decisive break above $4,070 WOULD invalidate the current bearish structure, but absent such momentum, the path of least resistance appears downward.

Ethereum Faces Bearish MACD Signal Despite Institutional Accumulation

Ethereum's price action shows vulnerability as analysts flag a looming bearish MACD crossover on weekly charts—a pattern historically associated with 40-60% corrections. The asset struggles below $4,200 after repeated rejections near $4,700, reflecting waning short-term momentum.

Structural support remains robust, with higher lows since early 2025 and the $3,700 zone acting as a springboard. BitMine Immersion's $417 million ETH purchase underscores institutional conviction, strategically accumulating during dips to reduce exchange supply. This mirrors growing confidence in Ethereum's staking ecosystem and scalability roadmap.

BitMex Makes $417M Ethereum Purchase, Signaling Institutional Confidence

BitMex has acquired 104,336 Ethereum tokens worth approximately $417 million, deploying capital across multiple wallets to minimize market disruption. The strategic accumulation underscores a broader institutional pivot toward Ethereum as CORE digital infrastructure rather than speculative asset.

The transaction was executed via regulated custodians Kraken and BitGo, with funds distributed evenly across three new wallets. This methodical approach reflects institutional-grade participation adhering to compliance standards.

Market analysts interpret the move as a contrarian bet during current volatility, with sophisticated players accumulating strategic positions. Ethereum's technical valuation and long-term utility appear to be driving billion-dollar allocation decisions.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH has the potential to reach $6,400 in the next bullish wave, though several resistance levels must be overcome. The current price of $3,840 represents a key support test, with the $3,500 level serving as critical support.

| Price Level | Significance | Probability |

|---|---|---|

| $3,500 | Critical Support | High |

| $4,234 | 20-day MA Resistance | Medium |

| $4,766 | Upper Bollinger Band | Medium |

| $6,400 | Bullish Target | Low-Medium |

| $6,800 | Extended Bull Target | Low |

BTCC financial analyst William suggests, 'The path to $6,400 requires breaking above the $4,234 resistance and sustaining momentum. Current institutional accumulation provides fundamental support for this scenario.'